Name of the strategy: Dancing with EMA (given by owner)

Strategy collected from: FF

Currency pair: EUR/USD, GBP/USD, EUR/JPY

Time frame: 4H

Indicator: 50 EMA & 5 SMA

Trading Environment: Trending market

Entry point:

Long: when 5 SMA crosses from below to above of 50 EMA and closing candle goes at least 100 pips....then enter long position after closing of current candle 100 pips away from 50 EMA.....

Short: Vice versa...

S/L: 100 pips

Progress: We'll enter again when the 5 SMA touches the 50 EMA with a stop loss 100 pips and the difference between two order should be at least 80 pips and the S/L of first order should be brought to the level of second order.... continue this until stop loss hit....

Now, let's go for an example....

| |

| GBP/USD pair |

See the 5 SMA line crosses above the 50 EMA line to go beyond 100 pips.....After crossing the target pips... a long position taken.... Now check where is the position of crossing 100 pips..

|

| GBP/USD pair |

Order was placed on the next candle.... it was a late call though, as usual.... Now wait to see what happens next.... See now... after weekend.... gain of > 50 pips

| |

| GBP/USD pair |

EUR/USD pair:

EUR/JPY pair:

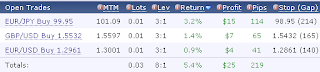

I'll post the progress later.... Now, 130+ pips in all three pairs (on 23.01.2012)....

On 24.01.2012 --

GBP/USD pair: 44+ pips

EUR/USD pair: 60+ pips

EUR/JPY pair: 65+ pips

Total 170+ pips (on 24.01.2012).....

On 25-01-12:

On 26-01-12:

On 28-01-12: